Planning for your child's education is one of the most important financial decisions you'll make as a parent. With options like the Gerber College Plan and 529 plans available, it's crucial to understand the differences and benefits of each. Both plans aim to help families save for higher education, but they operate differently and cater to different needs. This article will explore the nuances of both plans, helping you make an informed decision for your child's future.

Education costs continue to rise, and many parents are searching for the best way to save for their children's college expenses. Whether you're considering the Gerber College Plan or a 529 plan, it's essential to evaluate each option carefully. Both plans offer unique advantages and disadvantages that align with different financial goals and circumstances.

Our goal is to provide a detailed comparison of the Gerber College Plan vs 529, ensuring that you have all the necessary information to choose the right plan for your family. By the end of this article, you'll have a clear understanding of how each plan works, their benefits, and the potential drawbacks to consider.

Read also:Shoprite Store Locator Pa Your Ultimate Guide To Finding The Closest Shoprite In Pennsylvania

Table of Contents

- What is the Gerber College Plan?

- What is a 529 Plan?

- Cost Comparison: Gerber College Plan vs 529

- Tax Advantages of Each Plan

- Flexibility in Using Funds

- Risk Considerations

- How to Choose the Right Plan for You

- Common Mistakes to Avoid

- Expert Recommendations

- Conclusion

What is the Gerber College Plan?

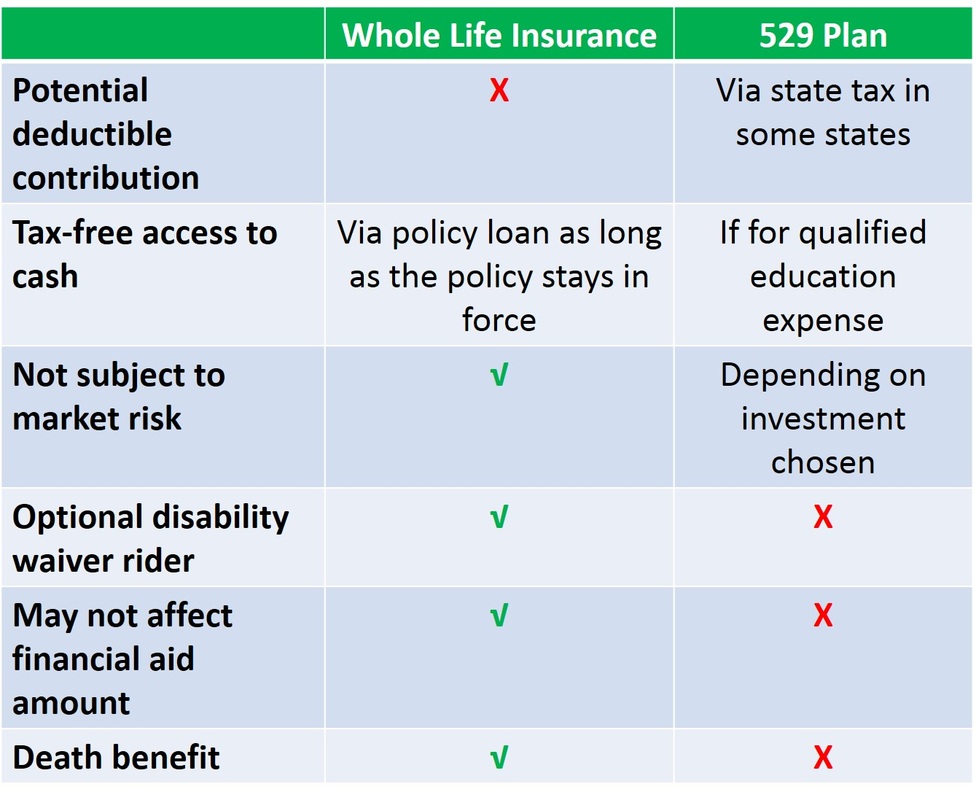

The Gerber College Plan is a life insurance policy designed to help families save for their child's education. It works by accumulating cash value over time, which can be used to pay for college expenses. One of the key features of this plan is its guaranteed growth, making it an attractive option for those seeking stability and predictability in their savings.

This plan is particularly appealing to parents who want to ensure their child has access to funds regardless of future tuition costs. Unlike traditional savings accounts, the Gerber College Plan offers life insurance coverage, providing an additional layer of financial security.

Key Features of the Gerber College Plan

- Guaranteed cash value growth

- Life insurance coverage

- No market risk

- Flexible withdrawal options

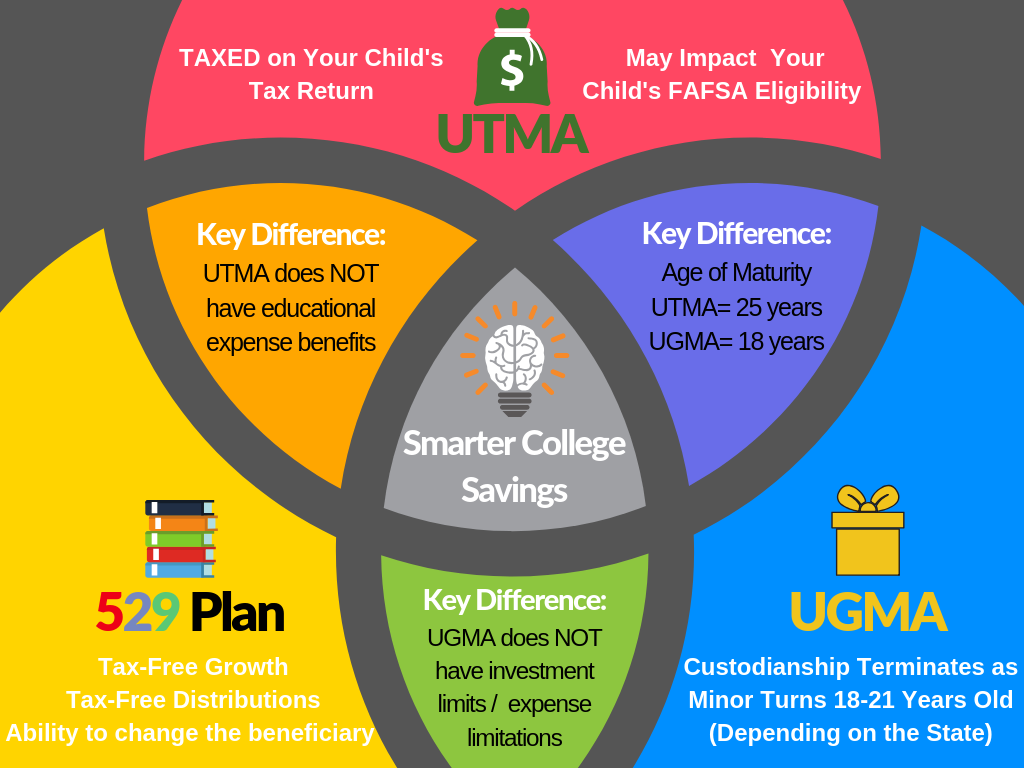

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. These plans are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code. They offer significant tax benefits and flexibility in terms of investment options.

One of the primary advantages of a 529 plan is its potential for growth through investments. While there is some risk involved, the potential for higher returns makes it an attractive option for those with a longer time horizon.

Types of 529 Plans

- Savings plans: Invest in mutual funds or ETFs

- Prepaid tuition plans: Lock in current tuition rates

Cost Comparison: Gerber College Plan vs 529

When comparing the Gerber College Plan and 529 plans, cost is a critical factor to consider. The Gerber College Plan typically has lower upfront costs but may have higher fees over time due to its life insurance component. On the other hand, 529 plans often have lower fees but may require higher initial investments.

It's important to evaluate the long-term costs of each plan and how they align with your financial goals. Consulting with a financial advisor can help you make an informed decision based on your specific situation.

Read also:When Did Aubreigh Wyatt Gain Fame Exploring Her Journey To Stardom

Example Costs

- Gerber College Plan: $25 monthly premium

- 529 Plan: $100 initial investment with $50 monthly contributions

Tax Advantages of Each Plan

Both the Gerber College Plan and 529 plans offer tax advantages, but they differ in how these benefits are structured. The Gerber College Plan provides tax-deferred growth on its cash value, meaning you won't pay taxes on the growth until you withdraw the funds. Additionally, the life insurance component may offer tax-free death benefits.

529 plans, on the other hand, offer tax-free withdrawals for qualified education expenses. Contributions grow tax-free, and withdrawals are not subject to federal taxes if used for eligible expenses. Some states also offer additional tax incentives for contributions to their state-sponsored 529 plans.

Tax Benefits Comparison

- Gerber College Plan: Tax-deferred growth, potential tax-free death benefits

- 529 Plan: Tax-free growth and withdrawals for qualified expenses

Flexibility in Using Funds

Flexibility is another important consideration when comparing the Gerber College Plan vs 529. The Gerber College Plan offers more flexibility in terms of how funds can be used. While it is primarily intended for education expenses, the cash value can be withdrawn for any purpose without penalty. This makes it a versatile option for families with diverse financial needs.

529 plans, while flexible in terms of investment options, are more restrictive in how the funds can be used. Withdrawals must be used for qualified education expenses to avoid penalties and taxes. However, the definition of qualified expenses has expanded over the years, including K-12 tuition and student loan repayments.

Flexibility Comparison

- Gerber College Plan: Funds can be used for any purpose

- 529 Plan: Funds must be used for qualified education expenses

Risk Considerations

Risk is an important factor to consider when evaluating the Gerber College Plan vs 529. The Gerber College Plan offers a guaranteed cash value growth, making it a low-risk option. However, the returns are generally lower compared to investment-based options like 529 plans.

529 plans involve market risk, as their value is tied to the performance of the underlying investments. While this means there is potential for higher returns, it also carries the risk of loss. Investors should carefully consider their risk tolerance and time horizon before choosing a 529 plan.

Risk Comparison

- Gerber College Plan: Low risk, guaranteed growth

- 529 Plan: Market risk, potential for higher returns

How to Choose the Right Plan for You

Choosing between the Gerber College Plan and a 529 plan depends on several factors, including your financial goals, risk tolerance, and time horizon. Families who prioritize stability and flexibility may find the Gerber College Plan more appealing, while those seeking higher potential returns may prefer a 529 plan.

Consider consulting with a financial advisor to assess your unique situation and determine which plan aligns best with your goals. Factors such as state tax incentives, investment options, and fees should all be taken into account when making your decision.

Key Considerations

- Financial goals

- Risk tolerance

- Time horizon

- State tax incentives

Common Mistakes to Avoid

When evaluating the Gerber College Plan vs 529, it's important to avoid common mistakes that could impact your savings strategy. One common mistake is underestimating future education costs, leading to insufficient savings. Another mistake is failing to consider the tax implications of each plan, which can affect the overall value of your savings.

Additionally, some families overlook the importance of diversifying their savings strategies. Combining multiple approaches, such as a Gerber College Plan and a 529 plan, can provide a more robust financial safety net for your child's education.

Avoid These Mistakes

- Underestimating future costs

- Ignoring tax implications

- Not diversifying savings strategies

Expert Recommendations

Financial experts recommend a thorough evaluation of both the Gerber College Plan and 529 plans before making a decision. They emphasize the importance of understanding the long-term costs, tax benefits, and flexibility of each plan. Additionally, experts suggest considering your state's specific 529 plan offerings, as some provide additional benefits such as state tax deductions.

For those who want a guaranteed, low-risk option, the Gerber College Plan may be the better choice. However, for families with a longer time horizon and a higher risk tolerance, a 529 plan could offer greater potential for growth.

Expert Tips

- Evaluate long-term costs

- Understand tax benefits

- Consider state-specific 529 plan features

Conclusion

Choosing between the Gerber College Plan and a 529 plan requires careful consideration of your financial goals, risk tolerance, and time horizon. Both options offer unique advantages and disadvantages, making it essential to evaluate each plan's features and benefits thoroughly. By understanding the differences and consulting with a financial advisor, you can make an informed decision that aligns with your family's needs.

We encourage you to take action by reviewing your current savings strategy and exploring the options available. Leave a comment below sharing your thoughts on the Gerber College Plan vs 529, and consider sharing this article with others who may find it helpful. For more insights into financial planning, explore our other articles on education savings and investment strategies.

Sources: IRS Website, SEC Website, TreasuryDirect